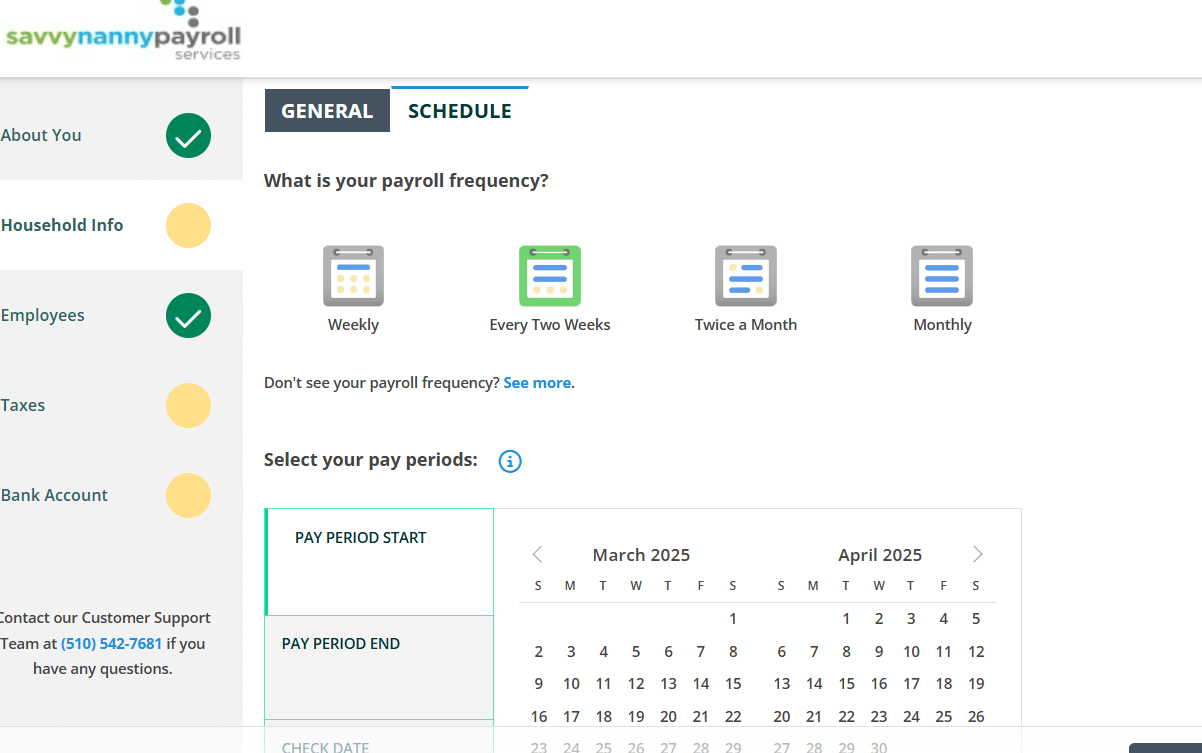

Enjoy fast and guided account setup with thoughtful features.

- Each step of the way we help you find the answers to fill in the blanks.

- Our easy interface collects all the information to get your payroll and tax payments going soon.

- We use a simple payroll setup interface.

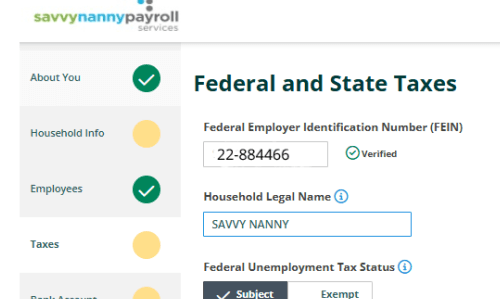

Federal EIN? Easy as pie! You will be set up in minutes with our guidance.

State tax and unemployment account numbers? Let us do the work for you. In most cases we can just obtain these on our own. In states that require personal information from you, we will walk you through with ease. No more navigating state tax revenue authority websites for you!

Incorporating thoughtful features, like Plaid, for checking bank account information, reducing error headaches.

EIN verifications on the spot! We guide you each step of the way in getting your Federal EIN and State account numbers. It is not difficult when you have someone guiding you each step of the way. Federal EIN’s are especially easy to obtain. Some payroll services charge clients a “setup fee” to obtain these numbers on your behalf. But there is no reason to pay for something that is easy to do with a few pointers.

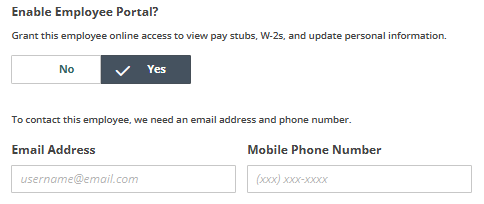

Simple setup of an employee portal so your employees can view their paystubs, w-2’s on their own.

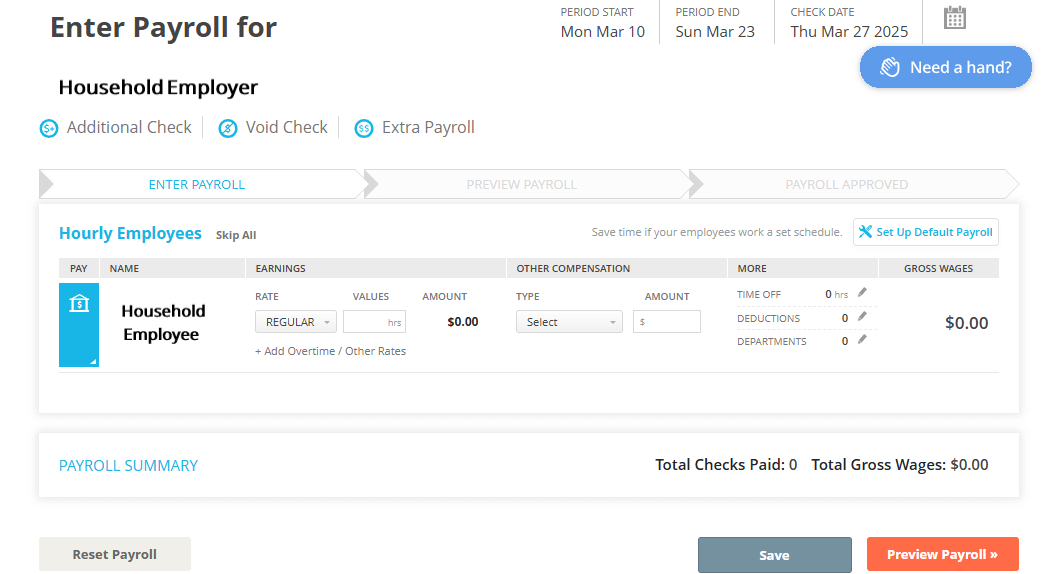

Once your payroll account is set up, running payroll is a cinch. You can automate or request email reminders with links to input hours worked.

Your email reminder will send you here, where you will enter hours worked, then click “preview payroll”

And voila!, your payroll is ready for approval

Taxes are automatically impounded. That means you do nothing. We file and pay all Federal, State, and Local Taxes for you!

Need to see a report of what was paid and filed on your behalf? The Reports Tab keeps it neat and tidy for you.

Need help? We are here to help in whatever way works for you whether that be online walkthroughs, chat, phone or email.